© Copyright | 2026 | TG 2050 LTD | Freetown | Hong Kong | All Rights Reserved

What exactly is the GO-FOR-GOLD Permanent Residency application procedure & what kind of steps can be expected?

Where can I view the GO-FOR-GOLD Permanent Residency application form?

What are the program fees for GO-FOR-GOLD Permanent Residency?

Single Applicant: USD65,000

Nuclear Family: USD75,000

Extended Family: USD100,000

APPLY NOW

What is the discount for investing in gold to qualify for GO-FOR-GOLD Permanent Residency?

You purchase 1KG at 2% discount to market price to qualify for PR then after 12 months you have the option to bid on up to a further 19KG to be supplied over 4 years at 2% discount to spot.

How is my investment in gold secured & what happens if there are problems in Sierra Leone or a change of government?

Gold is stored in the Central Bank of Sierra Leone. The Central Bank is an independent statutory corporation with both domestic and international reserves. A change of government does not impact its operations. In the unlikely event that there is a government chnage which is detrimental to your gold storage, the gold is insured against such loss. Finally to further improve security of your investment, some part of the national gold reserves is vaulted offshore.

What proof do I get of my ownership of the gold?

You get a Certificate of Deposit as well as an Assay Report issued by the relevant Statutory agencies.

How can I be sure there are no negative taxation consequences for me becoming a Citizen or Permanent Resident under the GO-FOR-GOLD program?

Section 99 of the Goods and Services Tax Act, 2009 of Sierra Leone.

“The Commissioner- General shall issue to a resident person and a non-resident person with no permanent establishment in Sierra Leone but whose income source is from Sierra Leone, a unique Taxpayer Identification Number (TIN), which number may be the same used to identify the person for the purposes of income tax, customs duty, Goods and Services Tax or non-tax revenue or any other transaction with the National Revenue Authority”.

To support the position that Sierra Leonean citizens or residents are taxed only on income sourced within Sierra Leone, the following sections of the Income Tax Act, 2000 are pertinent:

Section 89: Source of Income

Subsection (1):

“Income has a source in Sierra Leone if it is—

(a) derived from activities conducted, goods situated, rights used, or services rendered in Sierra Leone;

(b) derived from any employment exercised or services rendered in Sierra Leone, regardless of the place of payment;

(c) derived from the carrying on of a business in Sierra Leone; or

(d) a dividend, interest, royalty, rent, natural resource payment, or management or technical service fee paid by a resident of Sierra Leone.”

This section establishes that income is considered to have a Sierra Leonean source if it meets the criteria outlined above.

Section 91: Foreign Employment Income of Residents

“Foreign-source employment income derived by a resident individual during a year of assessment from employment in a foreign country shall be exempt from income tax if the income is chargeable to tax in the foreign country.”

This provision indicates that foreign employment income earned by a resident is exempt from Sierra Leonean tax if it is taxed in the country where it is earned.

Section 90: Allowable Foreign Tax Credit

Subsection (1):

“A resident taxpayer is entitled to an allowable tax credit in respect of foreign income tax borne by the taxpayer on assessable income derived from a foreign source.”

This section allows residents to claim a tax credit for foreign taxes paid on income earned abroad, mitigating double taxation.

In the Income Tax Act, 2000 of Sierra Leone, the term “resident individual” is defined in Section 10.

According to this section, an individual is considered a resident for tax purposes if they meet either of the following criteria:

- Physical Presence: The individual is present in Sierra Leone for a period or periods amounting to 183 days or more in any 12-month period commencing or ending during the year of assessment.

- Ordinary Residence: The individual resides in Sierra Leone and is not present in any other country for a period or periods amounting to more than 183 days in that year of assessment.

These criteria establish the basis for determining an individual’s residency status for taxation purposes in Sierra Leone.

Moreover …

- Sierra Leone has a self-reporting taxation system.

- Incorporated entities are mandated to undertake an annual audit but it is infrequently policed.

- Funds sent to Sierra Leonean entities can be treated as capital inflows and can readily be outflowed as the banking system is open and does not impede or question why an entity might be repatriating and expatriating funds.

Consequently, on the basis that our clients elect to report tax due annually, the National Revenue Authority will issue a Tax Residency Certificate.

Details on domestic taxation can be found here.

Can I get a passport in Sierra Leone?

Yes. Sierra Leone offers the following GO-FOR-GOLD pathways to Citizenship and with it a passport.

Fast Track Naturalization in 90 days.

Here you must be contributing economically to Sierra Leone.

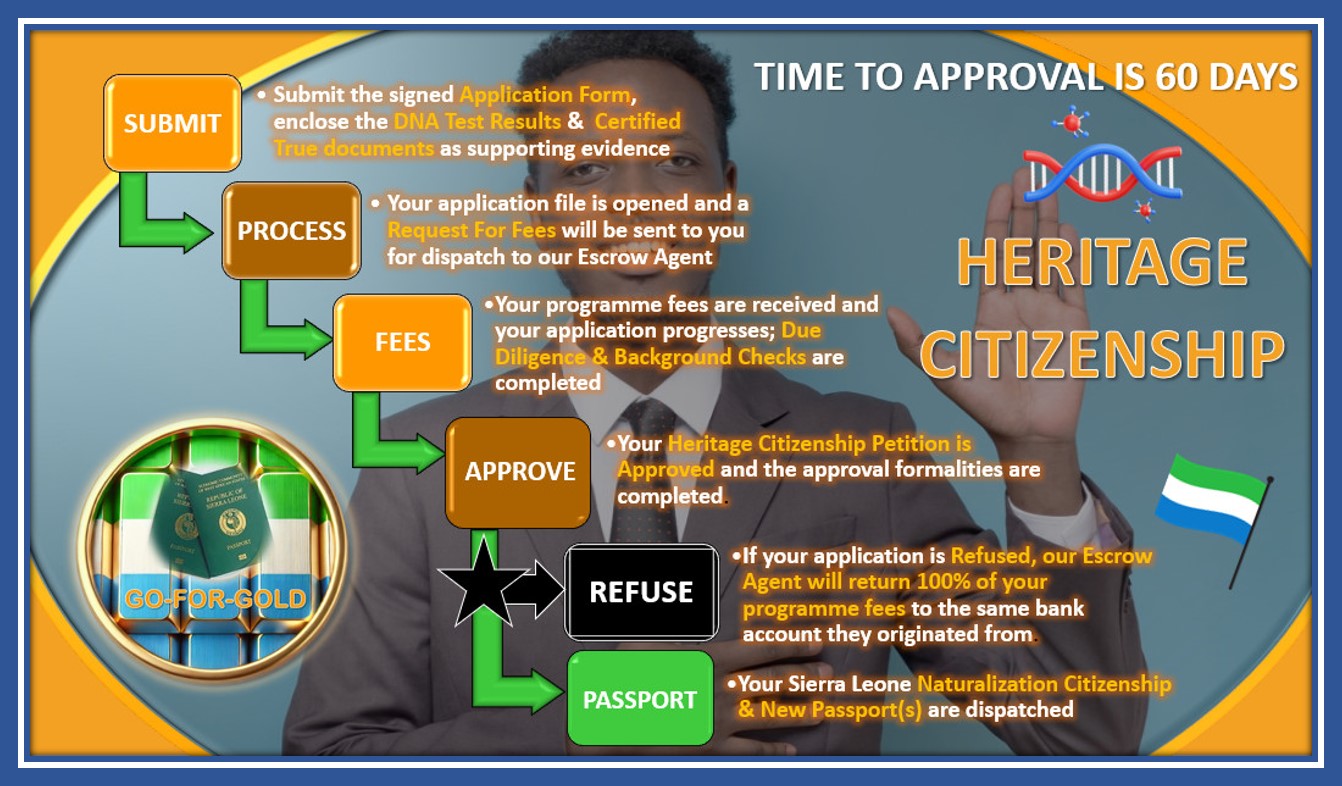

Heritage Naturalization in 60 days.

If you can prove African Ancestry by way of a specific DNA test.

Upgrade Naturalization

Where you have previously secured GO-FOR-GOLD permanent residency though investment in gold.

Please COMPLETE THE FORM HERE to find out more.

Can I upgrade from Permanent Residency to Citizenship later if this makes sense for me?

Yes – you sure can. This is how.

WATCH VIDEO HERE

Do both Permanent Residency & Citizenship in Sierra Leone automatically qualify me for residency throughout ECOWAS?

What exactly is the GFG Club & what value will it add to my Permanent Residency or Citizenship?

The GFG Club is an exclusive membership offered to individuals who secure Permanent Residency or Citizenship through Sierra Leone’s GO-FOR-GOLD program. This prestigious club enhances the value of the program by providing members with unique privileges and opportunities.

As a member, you gain 5-year access to discounted purchases of 99.99% pure bullion gold (stored securely in government reserves or available for immediate export).

Beyond financial benefits, the GFG Club fosters valuable connections with Sierra Leone’s top business leaders and public-private sector initiatives, empowering members to play an active role in the nation’s economic growth.

Members also enjoy streamlined services, such as in-country Concierge arrangements, business incorporation support, personalized government introductions, and invitations to exclusive events that keep you informed and connected.

The GFG Club creates a gateway to stability, opportunity, and belonging in a rising African nation, making it an invaluable addition to the lives of those seeking a secure future and meaningful connections in your new adopted country.

GFG CLUB WEBSITE HERE

DOWNLOAD INFO SHEET HERE

What is included in the GO-FOR-GOLD Permanent Residency & Citizenship program fees?

The program fees for Sierra Leone’s GO-FOR-GOLD Citizenship and Permanent Residency programs are structured to be comprehensive and all-inclusive, offering a seamless and transparent experience for applicants.

These fees cover every aspect of the application process, ensuring there are no hidden costs or unexpected expenses.

Included in the fees are government contributions, which directly support Sierra Leone’s socio-economic development, demonstrating a meaningful investment in the nation’s future. Additionally, the fees encompass due diligence checks to maintain the integrity and security of the program, guaranteeing that only qualified and vetted applicants are approved.

Documentation preparation, including assistance with application forms, certifications, and legal compliance, is also covered, alongside official government fees required for processing Passport and PR Cards.

By consolidating these elements into a single, all-inclusive fee, the GO-FOR-GOLD program simplifies the pathway to obtaining Citizenship or Permanent Residency, providing applicants with confidence, clarity, and peace of mind.

What are the 7 key reasons for the introduction of the GO-FOR-GOLD Permanent Residency & Citizenship programs?

1. Modernization of Immigration Services

The Sierra Leone Immigration Department (SLID) is undergoing a transformative modernization effort to streamline its systems and services. By introducing new Naturalization pathways, the country aims to attract foreign investment, talent, and partnerships while positioning itself as a forward-thinking player in Africa’s development story. New regional offices and integrated National Identification Numbers ensure accessibility and efficiency for applicants and citizens alike.

2. Strengthening Sierra Leone’s Global Standing

Through reforms and international agreements, such as the Memorandum of Understanding with Belgium, Sierra Leone is building credibility on the global stage. These efforts are anticipated to lead to expanded visa-free or ETA travel opportunities, making the country more connected and competitive internationally.

3. Pathways with Investment Potential

The Naturalization pathways include discounted gold purchases for new citizens, offering a unique financial advantage. These purchases can offset the cost of Citizenship and potentially provide a return on investment, adding tangible financial value to Sierra Leonean citizenship.

4. Sovereign Wealth and National Resources

Sierra Leone’s untapped wealth in gold, diamonds, and other resources provides a foundation for shared prosperity. Much like Norway’s oil wealth benefits its citizens, Sierra Leonean Citizenship offers intrinsic value beyond visa-free travel, holding significant long-term potential as the nation develops.

5. Lessons from Rwanda: Overcoming Perception

Sierra Leone draws inspiration from Rwanda’s transformation, demonstrating how resilience and strategic investment can reshape national narratives. Overcoming its Hollywood-induced image, Sierra Leone aims to mirror Rwanda’s success in infrastructure, governance, and inclusive development.

6. Inclusivity and Diaspora Engagement

The new pathways prioritize inclusivity, targeting both high-net-worth individuals and those with ancestral ties to Sierra Leone. By welcoming the African diaspora and international investors, the nation strengthens its socio-economic fabric while fostering regional influence and diversification.

7. ECOWAS Membership and Regional Integration

Sierra Leonean Citizenship grants membership in ECOWAS, offering regional mobility and access to member state institutions. While ECOWAS faces shifts with the departure of Burkina Faso, Mali, and Niger, Sierra Leone remains committed to regional collaboration, emphasizing stability and integration for its citizens.

What is the application process for GO-FOR-GOLD Fast Track Naturalization & how long does it take?

Where can I view the GO-FOR-GOLD Fast Track Naturalization application form?

What is the application process for GO-FOR-GOLD Heritage Naturalization & how long does it take?

Where can I view the GO-FOR-GOLD Heritage Naturalization application form?

What is third-party due diligence?

Third-party due diligence is an independent background screening done by our trusted partner, Harod Associates. It confirms your good standing, financial integrity, and overall eligibility for the GO-FOR-GOLD program.

Why is due diligence necessary?

It protects the integrity of the program and ensures all applicants meet global compliance standards. It also protects both you and the Government from reputational or legal risks.

Who conducts the due diligence checks?

All checks are conducted by Harod Associates, an accredited international firm appointed by GO-FOR-GOLD and approved by the Government of Sierra Leone. GO-FOR-GOLD doesn’t conduct or influence the findings.

Who is required to undergo due diligence?

Every applicant over the age of 18 must undergo due diligence screening before approval can be granted.

What information is required for the due diligence process?

We use your submitted application documents and provide these to our 3rd party due diligence provider.

Are the due diligence fees included in the program cost?

No. These fees are paid separately, and withdrawn from the money held in escrow. If your application is unsuccessful, your due diligence fees are non-refundable.

How much are the due diligence fees?

Due diligence fees are as follows: US $5,000 for up to 5 applicants; US $10,000 for 6–10 applicants; and US $900 per additional applicant above 10.

How long does the due diligence process take?

It takes our 3rd party due diligence providor 2 weeks to complete due diligence.

Why is there an incorporated company included?

In line with President Julius Maada Bio’s directive to encourage Direct Foreign Investment, every GO-FOR-GOLDprogram includes a company incorporated in Sierra Leone, with a corporate bank account.

Is there an additional cost for the company incorporation?

No. The setup is included in your GO-FOR-GOLD program fee. It includes a registered office, and a nominee for the first year.

What happens after the first year?

From year two, renewal fees for registered office and nominee services will apply at standard rates.

Can I choose my own company name?

Yes, as long as it’s available and follows Sierra Leone’s naming rules. We’ll guide you through the approval process.

Can I appoint my own directors or shareholders later?

Yes. You can update your company structure at any time in line with Sierra Leonean law. We or your service provider can assist with the filings.

EP1: December 15, 2024